As with any new foster carer applicants, we are keen to hear from those who want to make a positive impact on children’s lives. However, as you already know, fostering is a highly skilled role – and our fees and allowances reflect that.

The total fostering allowance that you receive will vary based on a number of factors, including the type of foster care you are providing, the number or children that you care for and their age, as well as the complexity of their needs.

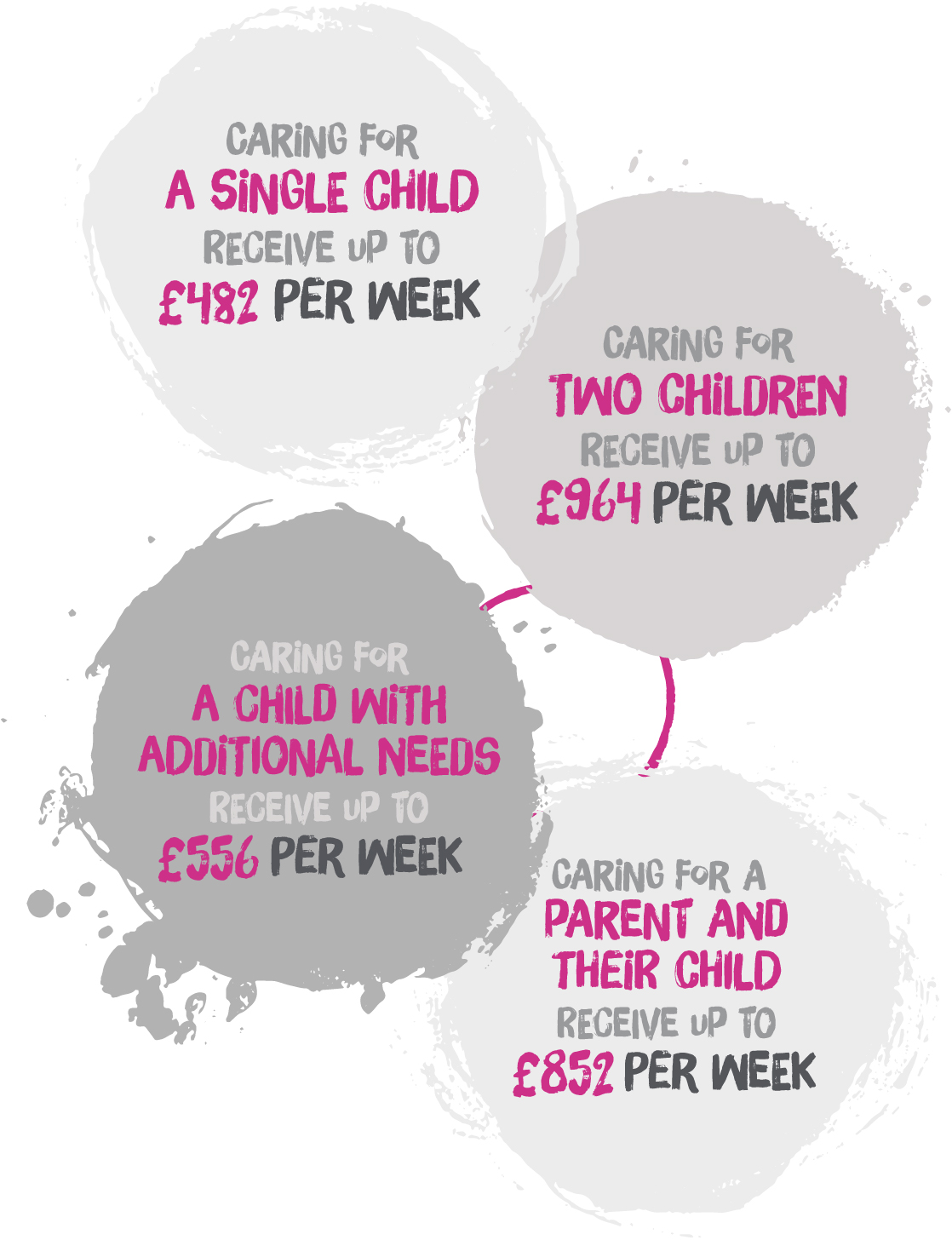

Here are some examples of the weekly allowances you could expect to receive:

In addition to the weekly fees, TACT foster carers receive extra payments to help cover the cost of significant events that occur while children are in placement. We know that special occasions such as religious festivals (e.g. Eid, Diwali, Christmas etc.), the child’s birthday and school holidays can be expensive. As such, if you have children in placement over these periods you will receive additional payments to help cover the costs.

You will receive £150 per child, to help celebrate their birthday(s). Likewise, another payment of £150 per child will be made to celebrate an annual religious festival. You will also receive £91 per week (for 13 weeks each year) holiday allowance for each child in your care.

We also pay long service awards and a Refer a Friend fee (if you recommend someone who then goes on to be an approved foster carer with us).

In light of the current cost-of-living crisis, TACT have put in place a number of additional financial benefits to help their foster carers during this period. Read more about TACT’s Cost-Of-Living Support For Carers.

In our ongoing commitment to support our carers financially, TACT will be contributing towards the cost of council tax for all of our approved foster carers.

From 1st April 2024, this contribution will be paid in two instalments annually, and will be linked to the length of your service as a foster carer:

As a transferring foster carer, your previous experience (in years) will count towards the amount you will receive.

As you will already know, foster carers are classed as self-employed and are subject to special tax arrangements – which in most cases mean you are unlikely to pay any tax on your income from fostering. As a reminder, there are two aspects to this Qualifying Care Relief (QCR):

1. A fixed tax exemption amount of £18,140 for each household for a full year

2. A weekly tax relief allowance for each child in your care:

Foster Carer Tax Example:

Your fostering allowance is £28,912* for the year.

You will be granted £18,140 (QCR) + £23,400 (weekly tax relief for child aged 11 or over) = £41,540

This means that you can earn up to £41,540 tax free from fostering per year.

Additionally your income is calculated after expenses, which means in most cases it is only the foster carer fee element that is taken into account in the tax calculations.

*based on fostering one child, aged 16+, with additional needs.