Fostering Allowance

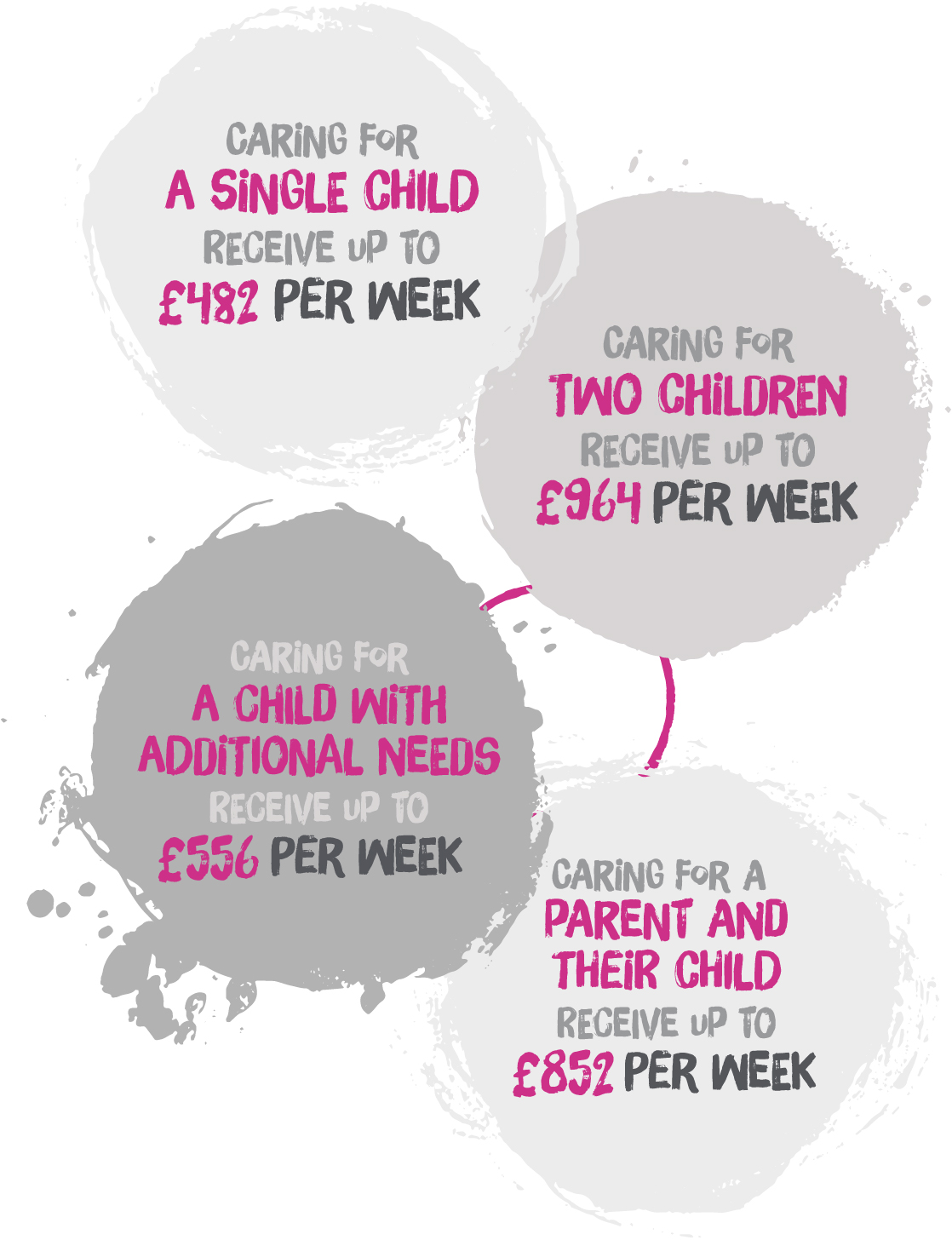

As soon as you’re an approved foster carer with TACT and begin caring for a young person, you will immediately receive a fostering allowance. For almost all foster carers, this allowance will be tax free and will not affect benefits you’re currently receiving.

We understand what a big decision it is to choose to become a foster carer. We also understand that talking about ‘fees’ and ‘money’ in relation to foster care can be a sensitive subject for some. Whilst the main motivation will always be make a difference to young people’s lives, it is important now more than ever to highlight the fostering allowance you will receive.